If you’re moving to Dubai solo, here’s the hard truth: your rent will make or break your budget. Most single people spend somewhere between AED 6,000 and AED 12,000 a month on living costs, before savings. If you want numbers you can actually use-and what drives them-this guide breaks it down clearly so you can plan with confidence. And yes, we’ll talk about how a car changes everything.

People ask about the Cost of living in Dubai -the monthly outlay for a resident covering housing, utilities, transport, food, healthcare, and leisure within the city. In 2025, a typical single professional with a one-bedroom and no car lands around AED 9,500-12,500 per month. Living frugally in a shared place? You can squeeze it to AED 4,000-6,000. Want comfort with a car and new-building perks? Think AED 17,000+.

TL;DR

- monthly expenses in Dubai for one person: AED 6k-12k for most; ultra-frugal shared living from AED 4k; car + premium lifestyle can hit AED 17k-23k.

- Biggest cost is rent: AED 3k-5k (shared), AED 6k-10k (1BR mid-range), AED 10k-15k (prime 1BR).

- Utilities (DEWA) in a 1BR: AED 300-800/month; internet AED 299-429; mobile AED 100-250.

- Transport: Metro pass AED 230-350; taxis AED 100-500; owning a car adds AED 1.8k-3k/month.

- Food: Groceries AED 800-1,600; eating out is the wild card (AED 300-1,200+).

What you’ll actually spend each month (2025 snapshot)

Dubai is a global city inside the United Arab Emirates -a Gulf country with a stable currency and low direct income tax. The UAE dirham (AED) is pegged at roughly 3.6725 AED to 1 USD, which helps with predictability. Prices below reflect what single residents actually pay in 2025, not tourist markups.

Three things swing your budget most: where you live, whether you drive, and how often you eat out. The rest is steady and easy to forecast.

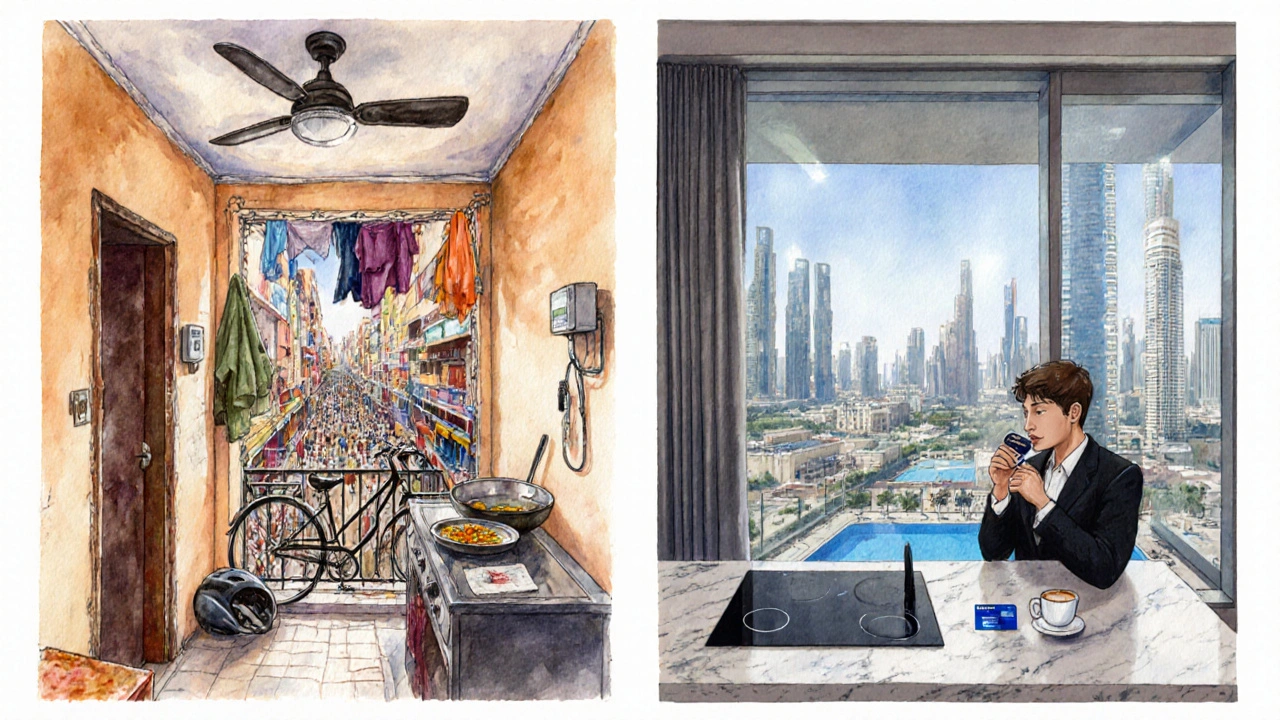

Housing: the decision that sets your whole budget

Rent is the anchor. In most budgets, it’s 40-60% of total spend. Market data from major portals like Bayut -a UAE real estate marketplace reporting annual rent trends and median prices shows 1-bedroom rents are still climbing in popular areas in 2025.

- Shared room/partition (Deira, Al Nahda, International City): AED 1,000-2,500

- Studio (JVC, Discovery Gardens, Al Barsha): AED 3,500-6,000

- 1BR mid-range (JVC, Al Barsha, older Business Bay/Marina): AED 6,000-10,000

- 1BR prime/newer (Downtown, Marina, Dubai Hills, City Walk): AED 10,000-15,000

Remember Dubai leases are annual. Many landlords want one to four cheques. Agency fees (2-5%), a refundable deposit (5% unfurnished, 10% furnished), and Ejari -the tenancy registration system, typically ~AED 220-are upfront. Spread those over 12 months to get a true monthly picture.

One more line that surprises newcomers: the Dubai Municipality Housing Fee -5% of your annual rent billed monthly via utilities. If your rent is AED 90,000/year, that’s AED 375/month on your DEWA bill.

Utilities and internet: what DEWA and telecom actually cost

Your utilities come from DEWA (Dubai Electricity and Water Authority) -the city’s electricity and water provider; typical deposits start around AED 2,000 for an apartment. A single in a 1BR usually pays AED 300-800 per month depending on building insulation and summer AC use. If your building has “chiller” cooling, sometimes that’s a separate line (check if it’s included in rent).

Home internet comes from Etisalat by e& -a UAE telecom operator offering fiber plans starting near AED 299/month or du -a telecom operator with comparable fiber bundles and optional TV/phone add-ons. Expect AED 299-429 for decent speeds. Mobile plans range widely: AED 100-250 gets most singles enough data; heavy users might hit AED 300+.

Heads up on taxes and fees: the UAE has a 5% VAT on most goods/services. Utilities also carry fuel surcharges that fluctuate.

Transport: metro is cheap, car convenience is pricey

Public transport is run by the RTA (Roads and Transport Authority) -operator of metro, tram, buses, and taxis. You’ll pay with a Nol card -a stored value card that also offers 30-day passes.

- 30-day pass: about AED 140 (1 zone), AED 230 (2 zones), AED 350 (all zones)

- Typical single-zone fare: AED 3-5; taxi base fare around AED 12+; per km ~AED 2.2-2.8

Driving? Budget changes fast:

- Car loan: AED 1,000-2,000/month (varies by car/tenor)

- Insurance: AED 200-400/month (annual paid upfront, amortized here)

- Fuel: AED 250-500/month (assuming ~3.0 AED/l and moderate city driving)

- Salik tolls: Salik -Dubai’s toll gates, AED 4 per pass, auto-charged from your account; many drivers spend AED 60-200/month

- Parking: AED 0-500/month depending on home/office arrangements

- Maintenance/registration: budget AED 100-200/month averaged

If you commute across town or value time flexibility, a car can be worth it, but it adds AED 1,800-3,000 to your monthly spend.

Food: your biggest variable after rent

If you cook most meals, solo grocery bills land around AED 800-1,600. A simple basket (milk, eggs, chicken, rice, veg, fruit, coffee) for one is ~AED 200-350/week depending on brands and where you shop.

- Budget lunch: AED 20-35 (cafeterias, shawarma, South Asian restaurants)

- Mid-range dinner: AED 120-200 per person without alcohol

- Coffee: AED 18-28; fresh juices: AED 12-25

- Alcohol: pricey-venue markups are real; a single drink often AED 50-80

Eating out twice a day vs twice a week can swing your budget by AED 1,000+ with zero change in rent.

Healthcare and insurance: small monthly line, huge when you need it

The Dubai Health Authority (DHA) regulates mandatory health insurance for residents; employers typically provide it. If you’re self-sponsored, you must buy a policy to process your visa. The Essential Benefits Plan (EBP) -the mandated basic tier-generally runs ~AED 750-1,800 per year depending on age/coverage; mid-tier expat plans are AED 2,500-5,000/year. That’s roughly AED 70-420/month. GP visit copays are common (AED 25-75), and branded meds are more expensive than generics.

Leisure, fitness, and small stuff that adds up

- Gym membership: AED 150-400 (premium brands AED 500-1,000)

- Cinema: AED 40-55

- Friday brunch: AED 250-450 (with soft drinks to alcohol)

- Streaming apps: AED 30-60 each

- Cleaning help: AED 35-50/hour; 4 hours weekly is ~AED 600-800/month

- Toiletries and household: AED 100-300/month

Three realistic monthly budgets for a single person

| Category | Frugal (Shared + Metro) | Mid-range (1BR + No Car) | Comfortable (1BR + Car) |

|---|---|---|---|

| Rent | AED 1,200-2,500 | AED 6,500-9,000 | AED 10,000-14,000 |

| Utilities (DEWA + housing fee) | AED 150-300 | AED 350-700 | AED 600-900 |

| Internet (home) | - (often none) | AED 299-429 | AED 299-429 |

| Mobile plan | AED 100-150 | AED 150-200 | AED 200-300 |

| Groceries | AED 700-1,000 | AED 1,000-1,400 | AED 1,200-1,800 |

| Eating out | AED 200-400 | AED 500-900 | AED 1,000-1,500 |

| Transport | AED 230-350 (metro) + AED 100 taxis | AED 230-350 (metro) + AED 200 taxis | AED 1,800-3,000 (car) |

| Health insurance | AED 70-150 | AED 120-300 | AED 170-420 |

| Gym/leisure | AED 0-150 | AED 150-300 | AED 300-700 |

| Cleaning | - | AED 0-300 | AED 600-800 |

| Misc/Buffer | AED 200-400 | AED 400-600 | AED 600-800 |

| Total | AED 3,850-5,300 | AED 9,300-12,980 | AED 16,969-24,349 |

These are living costs only. Savings, travel, and remittances are on top. Also, if your rent includes chiller or if you split internet with a roommate, totals drop.

One-time costs to spread across your first year

- Tenancy deposit: 5-10% of annual rent (refundable)

- Agency fee: 2-5% of annual rent

- Ejari: ~AED 220

- DEWA deposit: from AED 2,000 (refundable)

- Move-in fee (some buildings): AED 500-1,500

- Visa, medical, Emirates ID (if self-sponsored): variable; often AED 3,500-7,000 one-time

- Furniture and appliances: anywhere from AED 2,000 (IKEA starter) to AED 20,000+

A good rule: divide your total setup costs by 12 and add that to your monthly budget for the first year. It’s the only way to avoid getting blindsided.

Area-by-area rent cues (quick guide)

Dubai is a coastal city with dozens of distinct residential districts-from budget-friendly satellite areas to luxury, amenity-rich neighborhoods. Rents move by season and new supply, but typical 1BR ranges in 2025 look like this:

- Budget: International City, Al Nahda, Deira - AED 40k-60k/year

- Mid: JVC, Al Barsha, Dubai Silicon Oasis - AED 70k-100k/year

- Prime: Dubai Marina, Downtown, Business Bay, Dubai Hills - AED 110k-180k/year

Newer buildings often have better insulation (lower summer DEWA) and amenities (gyms, pools), but you pay for it in the rent.

How to build your own Dubai budget in 10 minutes

- Pick your housing bracket first (shared, studio, 1BR). That’s your anchor.

- Add utilities: AED 300-800 for a 1BR; AED 150-300 if you’re sharing.

- Decide on internet: AED 299-429 solo; split it if you can.

- Choose transport: Metro pass (AED 230-350) + taxis, or car (AED 1,800-3,000).

- Food: AED 800-1,600 groceries + whatever you realistically spend eating out.

- Healthcare: put AED 70-420 depending on your plan tier.

- Add lifestyle lines (gym, streaming, cleaning): AED 0-1,000 based on taste.

- Buffer: minimum 10% of the total. Dubai always finds a way to add a fee.

Practical tips that actually save money

- Rent for function, not for Instagram. Being one metro stop farther can cut AED 2k/month.

- Check if chiller is included. If not, ask for average bills from previous tenant.

- Use a two-zone or all-zone metro pass if you cross zones daily; pay-as-you-go otherwise.

- Batch errands to avoid extra Salik toll hits and paid parking.

- Cook on weekdays; save restaurants for weekends. That alone can save AED 800/month.

- Don’t overbuy mobile data. Review your usage; most people are fine at 6-10 GB on Wi‑Fi-heavy routines.

- Look for buildings with included amenities; a good gym on-site can remove a separate gym fee.

What changes the total the most?

Three levers are powerful:

- Moving from shared to a 1BR: +AED 4,000-7,000/month

- Adding a car: +AED 1,800-3,000/month

- Eating out 5-6 times a week vs once or twice: +AED 700-1,200/month

Small optimizations everywhere else might save AED 300-600 combined, but those big three choices decide 80% of your budget.

Entity quick references (for clarity)

When locals mention DEWA, they mean utilities. RTA is transport. Salik is tolls. Nol is your metro card. Etisalat and du are your internet/mobile providers. DHA is your health insurance regulator. Here’s a concise description of each for newcomers:

- DEWA Dubai Electricity and Water Authority-utilities provider, bills include electricity, water, sewerage, housing fee

- RTA Roads and Transport Authority-runs metro, tram, buses, licensing, and regulates taxis

- Nol The contactless card for Dubai public transport with pay-as-you-go and passes

- Salik Electronic toll system-AED 4 per gate; charges apply automatically

- Etisalat by e& Telecom operator-fiber internet, mobile plans, TV bundles

- du Telecom operator-fiber internet, mobile plans, TV bundles

- Dubai Health Authority The regulator for health insurance and healthcare policy in Dubai

Frequently Asked Questions

What is a realistic monthly budget for a single person in Dubai?

If you rent a mid-range one-bedroom and don’t own a car, AED 9,500-12,500 per month is realistic in 2025. That includes rent, DEWA, internet, mobile, groceries, some eating out, public transport, insurance, and a small buffer. With shared housing and a metro pass, you can run at AED 4,000-6,000. With a car and newer building in a prime area, AED 17,000-23,000 is common.

How much is DEWA per month for a 1-bedroom?

Expect AED 300-800 depending on AC use, insulation, and whether your building has a separate chiller fee. Don’t forget the monthly housing fee (5% of annual rent divided by 12) usually appears on the same bill.

Is it cheaper to live near the metro?

Usually yes on transport costs, but rent can be higher in super-connected areas. If you can walk to a station and use an all-zones pass (about AED 350/month), you may not need a car. That saves AED 1,800-3,000 per month compared to driving.

What about taxes in Dubai-do they affect monthly budgets?

There’s no personal income tax for most employees, but everyday spending has 5% VAT. Hotels and some restaurants add municipality and service charges. Your DEWA bill includes a fuel surcharge and the 5% housing fee based on your rent. These are baked into the ranges in this guide.

How much do I need to earn to live comfortably as a single?

Aim for net income at least 2× your monthly living costs. For a mid-range lifestyle without a car (AED 10k-12k), a take-home of AED 20k-24k lets you save and handle surprises. If you’ll own a car and rent in a prime area, you’ll be happier above AED 30k net.

Can I really live on AED 4,000 per month in Dubai?

It’s tight but possible with shared housing (AED 1.2k-2.0k), a metro pass, home cooking, and minimal extras. You’ll likely skip home internet, limit taxis, and keep a small buffer for emergencies. Many service industry workers manage this by sharing costs.

Is internet included in rent?

Rarely in private apartments. Some shared accommodations and co-living spaces include Wi‑Fi. Otherwise, expect AED 299-429/month from Etisalat or du. Many singles rely on mobile data only to save money, but home fiber is more stable for remote work.

How much does owning a car add to monthly costs in Dubai?

Between loan, insurance, fuel, tolls (Salik), parking, and maintenance, expect AED 1,800-3,000 monthly for a modest sedan and average city driving. Premium models or heavy commuting can push it higher.

Do employers cover health insurance?

Most do for employees, as required in Dubai. If you’re self-sponsored or on a family visa, you must purchase your own policy. Basic EBP plans start under AED 2,000/year; mid-tier with broader networks is AED 2,500-5,000/year.

Next steps and quick scenarios

- New arrival on a tight budget: Start with shared housing near a metro line, track your DEWA for a month, then upgrade once you’re settled.

- Remote worker: Pay for stable home fiber and a mid-tier mobile plan; you’ll likely save enough by skipping a car.

- Driver by necessity: Pick housing with free parking and minimal Salik gates on your route. Fuel-efficient car pays off quickly.

- Heat-proofing summer costs: Keep AC at 24-25°C, close blinds mid-day, and service AC filters. That alone can shave AED 100-250 off July/August bills.

- Buffering for surprises: Keep 10-15% of your budget aside. Deposits, move-in fees, and one-off government charges often pop up with little warning.

Bottom line: choose your rent, choose your transport, and you’ve locked 80% of your Dubai budget. Everything else is the fine-tuning that keeps your month comfortable.

Escort Dubai